What are the Pros and Cons of Investing in FDs? Know them Here.

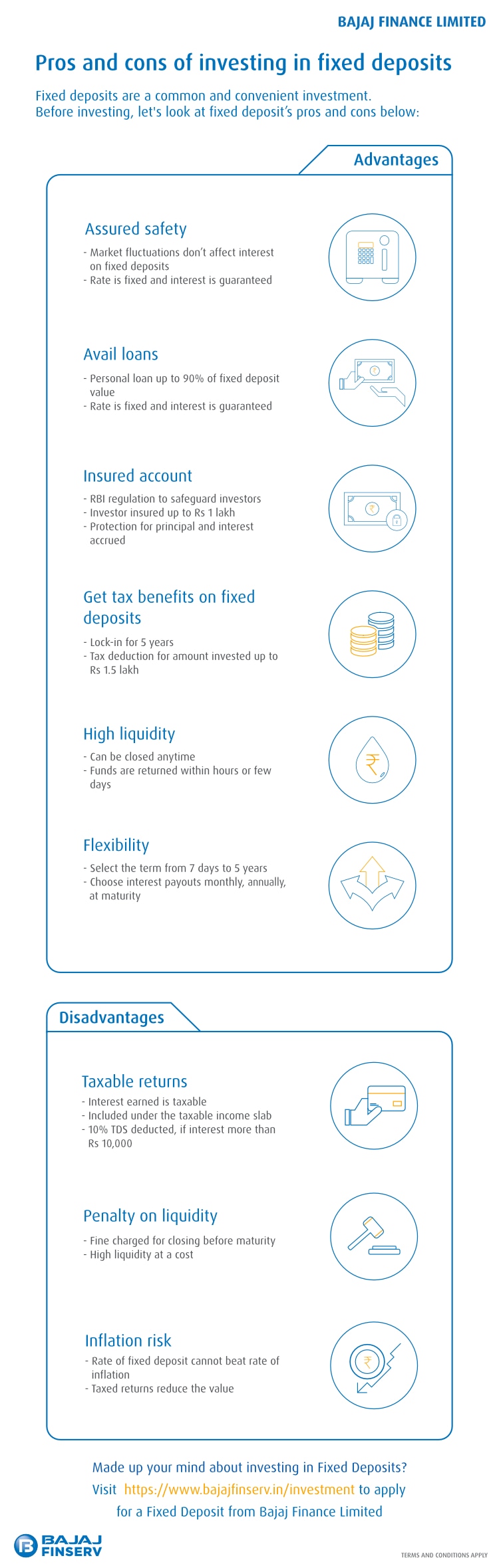

These infographics below display the various advantages and disadvantages of availing a Fixed deposit. FDs are one of the safest form of investing your hard earned money or spare cash. They are risk free as the interest you locked your money in does not change with time. On top of that you can now avail these loans from the comfort of your home by applying online. You could ask, don’t they (FDs) have anything undesirable about them. Yes, but the list of desirable things (advantages) outweigh undesirable (disadvantages) aspects with a big margin.

Let us have a look at the Advantages:

- Safety:-Unlike most other investments FDs do not have any effect on its interest rates because of market fluctuations. The interest rates remain the same and they are insured as well.

- Loans:-You may avail personal loans on your FDs! These loans could be 90% of the value of your FD account. Even here the rates are fixed and the interests are guaranteed

- Tax Benefits:-You can get tax benefits for up to 5 years in lock in and deductions for amount invested up to Rs. 1.5 Lakh

Now, let us see the Disadvantages:

- Returns are Taxable:-The interest you earn is taxable and is included in taxable income slab. If your interest accrued is more than 10% then 10% TDS is deducted.

- Liquidity Penalties:-If you close before maturity then you are liable for a fine also the liquidity is high at a cost

Post a Comment